The "Asset Valuation" of a Human Life

By quantifying the value of a life, not in abstract philosophical terms but in concrete financial ones, you create one of the most powerful motivators for health and safety.

Here is an analysis using three distinct financial dimensions to estimate this value, culminating in the statement you seek.

The "Asset Valuation" of a Human Life

To determine the value of this "asset," we can look at it from three perspectives:

This is the most direct cost. It's what you must pay (rough estimates) when a critical part fails due to neglect or damage.

Asset Value (Repair Basis): ₹1 Crore+

2. The "Economic Value" (Human Life Value - HLV)

This is the standard method used by insurance companies to value your life as an economic engine. It calculates the total income you will earn for your family over the rest of your working life.

Let's use a conservative example:

Annual Income: ₹8,00,000 (a modest formal-sector salary)

Working Years Remaining: 30 years

Simple HLV (no inflation/discount): ₹8,00,000/year × 30 years = ₹2.4 Crores

If your annual income is ₹15,00,000, your simple HLV is ₹4.5 Crores.

This figure represents the direct financial asset your health protects. If you lose your life, this is the minimum economic value lost to your family.

Asset Value (Economic Basis): ₹2.4 Crores to ₹4.5 Crores+

3. The "Societal Value" (Value of a Statistical Life - VSL)

This is perhaps the most comprehensive figure. The VSL is a metric used by governments to decide how much to spend on safety regulations. It asks: "How much is it worth spending as a society to prevent one statistical death?"

Studies for India have placed this value in a wide range, but recent analyses for policy-making (like those cited in road safety reports and academic papers) converge on a figure between ₹4.5 Crores and ₹5.5 Crores.

This figure is not what someone would "pay" for a life, but what a society collectively invests to protect one.

Asset Value (Societal Basis): ₹5 Crores

Conclusion: Your Personal Asset Valuation

Looking at these three dimensions, a clear picture emerges. The cost to repair you is in the crores. The economic engine you power is worth crores. The value society places on saving you is in the crores.

A conservative, defensible valuation of your life, based on what it costs to protect and what it produces, is ₹5 Crores.

This leads to the powerful, personal statement you were looking for:

"My life and body are a ₹5 Crore asset. I must therefore protect this asset with the same diligence I would give to any high-value investment."

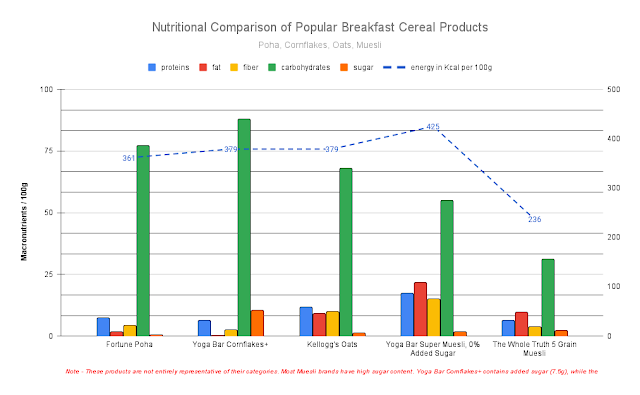

This simple sentence reframes everything. A 30-minute walk isn't a chore; it's asset maintenance. Choosing water over a sugary drink isn't deprivation; it's protecting your equity. A full night's sleep isn't lazy; it's a high-yield deposit into your most valuable account.

Here is an analysis using three distinct financial dimensions to estimate this value, culminating in the statement you seek.

The "Asset Valuation" of a Human Life

To determine the value of this "asset," we can look at it from three perspectives:

- The Repair Cost: What does it cost to fix the asset when it breaks?

- The Economic Value (HLV): What is the asset's future earning potential?

- The Societal Value (VSL): What is society (or government) willing to pay to protect this asset?

This is the most direct cost. It's what you must pay (rough estimates) when a critical part fails due to neglect or damage.

- Heart Bypass: ₹2.5 lakhs to ₹6 lakhs

- Kidney Transplant: ₹5 lakhs to ₹12 lakhs (plus ₹1.8 lakhs to ₹3.6 lakhs per year for dialysis, potentially for life)

- Liver Transplant: ₹15 lakhs to ₹30 lakhs

Asset Value (Repair Basis): ₹1 Crore+

2. The "Economic Value" (Human Life Value - HLV)

This is the standard method used by insurance companies to value your life as an economic engine. It calculates the total income you will earn for your family over the rest of your working life.

Let's use a conservative example:

Annual Income: ₹8,00,000 (a modest formal-sector salary)

Working Years Remaining: 30 years

Simple HLV (no inflation/discount): ₹8,00,000/year × 30 years = ₹2.4 Crores

If your annual income is ₹15,00,000, your simple HLV is ₹4.5 Crores.

This figure represents the direct financial asset your health protects. If you lose your life, this is the minimum economic value lost to your family.

Asset Value (Economic Basis): ₹2.4 Crores to ₹4.5 Crores+

3. The "Societal Value" (Value of a Statistical Life - VSL)

This is perhaps the most comprehensive figure. The VSL is a metric used by governments to decide how much to spend on safety regulations. It asks: "How much is it worth spending as a society to prevent one statistical death?"

When the Ministry of Road Transport and Highways (MoRTH) analyzes whether to build a safer flyover, they use a VSL to see if the cost of construction is "worth" the number of lives it's expected to save.

This figure is not what someone would "pay" for a life, but what a society collectively invests to protect one.

Asset Value (Societal Basis): ₹5 Crores

Conclusion: Your Personal Asset Valuation

Looking at these three dimensions, a clear picture emerges. The cost to repair you is in the crores. The economic engine you power is worth crores. The value society places on saving you is in the crores.

A conservative, defensible valuation of your life, based on what it costs to protect and what it produces, is ₹5 Crores.

This leads to the powerful, personal statement you were looking for:

"My life and body are a ₹5 Crore asset. I must therefore protect this asset with the same diligence I would give to any high-value investment."

This simple sentence reframes everything. A 30-minute walk isn't a chore; it's asset maintenance. Choosing water over a sugary drink isn't deprivation; it's protecting your equity. A full night's sleep isn't lazy; it's a high-yield deposit into your most valuable account.

So when you:

- Sleep properly

- Eat thoughtfully

- Exercise regularly

- Avoid addictive damage

- Manage stress

You are not just “being healthy.”

You are actively protecting a precious asset — your body.

And unlike material assets, this one defines the quality of your entire life.

Your health is already extremely valuable.

Treat it like it is.

(article polished with the help of Gemini)

Comments

Post a Comment